In this digital era, there is a phenomenal evolution in the IT field. Hence, every organization is looking forward to modernizing its IT infrastructure by introducing new technologies and applications in its ecosystem. SAP ERP is one of the softwares that helps organizations streamline various business functions and thus, manages complex business processes and information more efficiently. The software was established in 1992. Indeed, SAP software provides ERP (Enterprise Resource Planning) solutions and its main function is that it integrates different business solutions in a single system. Furthermore, this software can be used in a customized way, that meets specific business needs. Among the various modules of SAP ERP, FICO is a functional one.

Introduction:

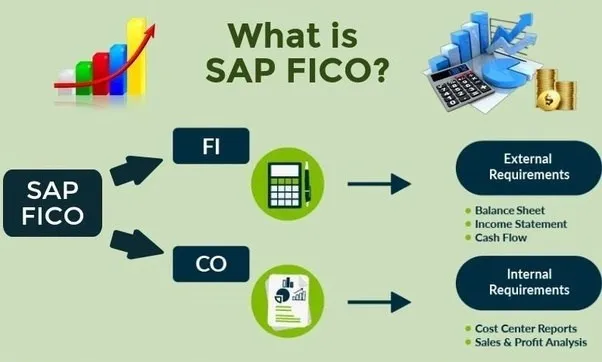

FICO stands for ‘Financial Accounting and Controlling’. As the name suggests, there are 2 modules of SAP FICO: i.e. SAP -Financial Accounting (FI) and SAP- Controlling (CO). Indeed, FICO helps organizations with managing financial data, making and analyzing finance reports and generating Financial Statements.

SAP FICO as a career brings numerous growth opportunities and intensive progression. The combination of financial expertise and FICO software modules makes these professionals an asset to the organization and hence they are offered lucrative packages. FICO professionals are often involved with cross-functional collaboration which not only helps them expand knowledge but also provides exposure to different industry verticals.

Uses of SAP FICO in any Organization:

1. Reduction in error:

There are no chances of error in any kind of reporting or data- management due to the consistency of all business transactions in any organization.

2. Profitable Business:

Business becomes more profitable due to the stability of SAP FICO.

3. Time-saving:

Organizations can indeed speed up the work of financial report preparation by streamlining all the business processes with FICO.

4. Fast decision-making:

SAP FICO helps create instant financial reports which eventually speed up the decision-making process.

5. Cost reduction:

Amidst various valuable features of this software, there is also a cost-saving feature. Hence, it becomes easier to cut the cost and save money.

6. General Ledger:

Using FICO software, Income, expenses, assets, and obligations like financial transactions can be tracked and managed easily.

7. Accounts Payable:

SAP FICO helps manage Vendor invoices, accounting procedures payments etc.

8. Accounts Receivable:

FICO helps manage various Customer Invoices, payments & receivables.

9. Asset Accounting:

The software has indeed made it easy to manage Fixed assets like heavy equipment, property, and land.

10. Bank Accounting:

Organizations use FICO for managing cash, bank statements, and Bank reconciliation procedures.

11. Cost Center Accounting:

When it comes to cost allocation, Organizations allocate a certain cost to specific centres like production, sales, and human resources. Here comes the role of SAP FICO, which is used to allocate the costs.

12. Profit Center Accounting:

Profit and loss analysis is also done through FICO at individual business units or profit centers.

13. Centralized data:

SAP FICO allows centralized data management. Hence, it becomes easy to manage all the information.

Scope of Finance Vs SAP FICO:

A job in SAP FICO role has some distinct responsibilities in terms of the tasks to perform and focus area as compared to a job in Finance. The comparison can be seen here:

SAP FICO:

- Specialized SAP Modules:

FICO is one of the modules in SAP ERP. This module is specifically designed for accounting and controlling purposes in any organization.

- Data Integration:

FICO is mainly used to integrate financial data from various departments in the organization into one SAP system for the purpose of accuracy in reports and analysis.

- Software Proficiency:

If one works with SAP FICO, he needs to be proficient in using ERP Software including Testing, Configuration, and Data management.

- Financial And Controlling Functions:

FI mainly focuses on Financial management, Financial reporting, and accounting whereas CO is more concerned with cost accounting, financial processes, and performance analysis.

- Business Processes:

FICO Professionals are mainly responsible for optimizing the financial and controlling processes to meet the organizational goals in compliance with financial standards.

- Jobs for SAP Users:

Jobs for FICO are found in the organizations where SAP system is used for financial functions.

SAP Finance:

- Strategic Decision-Making:

Financial professionals and executive team members jointly are responsible for making strategic financial decisions for the company.

- Regulatory Compliance:

Every industry has some specific set of financial regulations and accounting standards that the organization needs to meet. This task comes under the scope of a Finance person.

- Finance Functions:

A Finance person primarily handles Financial Planning and Analysis, Investment Management, and Risk Management,

- Accounting and Auditing:

At times Finance person is also involved in Accounting and Auditing.

- Broad Scope:

A job in Finance encompasses a broader range of roles.

- Jobs:

A Finance Person can get a job in diversified Industries including Banking, Manufacturing, Healthcare and Technology, etc.

SAP FICO Consultant Requirements and Skills:

- Strong Analytical and Problem-solving skills.

- Communication skills and Client Facing Skills should be excellent.

- Good Understanding of FICO modules. This includes Configuration and Testing also.

- Experience in Accounting and Reporting processes.

- Project Management

- Data Migration

- Analytical skills

- Profitability Analysis

- Financial Statement Analysis

- Accounting Process Knowledge

- Business Process Analysis

Best SAP FICO Course – Henry Harvin

Certainly, SAP FICO course can lead one to becoming a FICO Consultant. Henry Harvin provides SAP FICO Training. Moreover, this program delivers the understanding and expertise that a professional needs to manage Accounting and Reporting in any organization.

Furthermore, SAP FICO Course from Henry Harvin has been ranked no.1 by Tribune. Moreover, It is a 24-hour Live Online Interactive Classroom Course.

SAP FICO Training Course from Henry Harvin:

Curriculum:

FICO Program has a set of total 16 Modules:

- Introduction to ERP

- SAP FI Financial Accounting Basic Settings

- SAP FI General Ledger Accounting

- SAP FI Accounts Payable

- SAP FI Accounts Receivable

- SAP FI Asset Accounting

- SAP FI Reports

- Bank Accounting

- SAP CO CONTROLLING Basic settings for controlling

- SAP CO Cost Center Accounting

- SAP CO Internal Orders

- SAP CO Profit Center Accounting

- SAP CO COPA Reporting

- SAP Integration

- Complimentary Module 1: Soft Skills Development

- Complimentary Module 2: Resume Writing

Key Skills of the FICO course:

FICO program helps the trainees with the skills of Financial Accounting, Profitability Analysis, Data Management, Cost Center Accounting, Budgeting, Forecasting, and Regulatory Compliance.

What one can learn in this course:

FICO program gives the understanding and learning of the Basics of ERP, the Responsibilities of SAP FICO Consultant. Also, it creates a chart of Accounts, SAP FI General Ledger Accounting, Automatic Payment Program, and Basic Settings of Controlling in SAP.

Exclusive Course Offerings:

By enrolling in the Henry Harvin FICO program, one gets the golden opportunity to get some exclusive course offerings. Furthermore, this provides you with Unlimited Class Repetitions, Native Experienced Trainers, Job Opportunities for Experienced And Freshers in India, the Middle East, and the US, Industrial Knowledge, SAP Global certification curriculum,100 % Money-Back Guarantee.

SAP is in high demand these days. For this reason, Henry Harvin offers other SAP courses also like SAP MM Training and SAP SD Training.

Benefits of enrolling in the Henry Harvin FICO Program:

- One can learn to make Financial reports that help in data-driven decision-making.

- Develop skills in profitability analysis. Improve Overall efficiency of the organization with the understanding of how to Integrate various modules in one system.

- Support in strategic planning by mastering budgeting techniques.

- Get a handsome amount of income from reputed firms.

The FICO Training course at Henry Harvin is designed in such a way that helps organizations meet their business needs. Furthermore, the trainers at Henry Harvin have distinctive Training Delivery Methods that help the learners to understand the organization’s financial planning and analysis in a better way and thus make better Financial decisions. Today, 80% of transactions of any sort pass through SAP system. Hence, doing a SAP Course is certainly a good choice. One can enroll in SAP PP Training from Henry Harvin.

Conclusion:

SAP FICO Training program is in high demand. The increasing complexities of financial processes and regulations is the key factors of companies seeking for FICO Professionals. Moreover, the integration of Accounting and Controlling functions in SAP software helps organizations with streamlined processes and improved decision-making capabilities.

Recommended Reads:

- What is SAP Certification? Eligibility, Advantages and Cost

- SAP Course: Details, Eligibility, Syllabus, Career, Fees, Scope and More

- Top 20 SAP FICO Interview Questions and Answers

- Top 13 SAP FICO Training in the USA: 2024 [Updated]

- Top 7 SAP Certification Training In Saudi Arabia

FAQs:

Q1- Is SAP FICO a good career for me?

Ans: Yes, SAP FICO is indeed an excellent career. SAP FICO Professionals are highly in demand so this career gives you job security. Also, there is continuous learning in this field, hence this gives you personal growth.

Q2- Who can enroll in SAP FICO course?

Ans: A graduate having a background of Accounts or Finance can definitely go well with this program.

Q3- How much remuneration will I get initially?

Ans: Freshers are eligible to get a salary of 2 lac to 5 lac per annum. But a few years of experience can bring you a salary of 10 lac to 15 lac per annum.

Q4- What kind of roles will I get in a job post-completion of FICO Course?

Ans: This course certainly offers you the roles of Consultant, CFO, FICO Lead, or FICO Architect.

Q5- Is there any Technical Skill with SAP Software that one needs to have to enroll in SAP FICO Course?

Ans: No, to enroll in the FICO Course, you do not require any Technical proficiency with SAP software, unlike other SAP courses.