In today’s tech-driven world, 80% of corporations run their businesses using SAP to handle financial transactions. This shows the demand and importance of learning the SAP FICO course in 2025. Moreover, employers choose candidates who are experts in both accounting and technology. As a result, the demand for SAP FICO has increased in 2025. Additionally, learning the SAP FICO course simultaneously increases one’s knowledge in technical skills and results in high-paying jobs. As more businesses turn to digital systems, the SAP FICO course has gained attention worldwide.

Through reading this blog, you can have a clear understanding of the SAP FICO course syllabus, fee details, the duration, and the eligibility criteria for the SAP FICO course. A few details regarding the course may differ according to each institute.

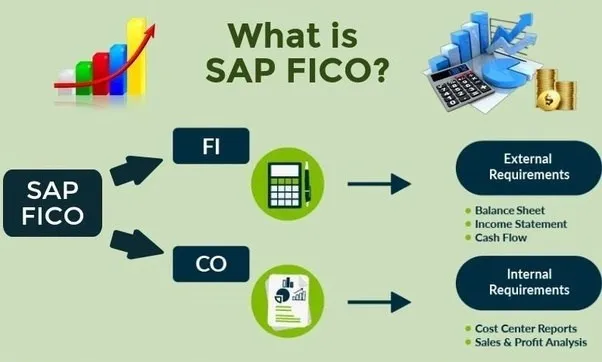

What is SAP Finance and Controlling Training?

The SAP FICO course is a detailed training program that covers two main components in SAP ERP modules: FI- Financial Accounting and CO-Controlling.

Financial accounting covers the external reports such as the balance sheet, profit and loss, accounts payable, and receivable. It also covers tax configuration.

On the other hand, Controlling focuses on internal reports, the cost management in business. Moreover, learning the SAP FICO course, they gain in-depth knowledge in financial processes and integrate with other business areas like logistics, supply chain, and human resources. As a result, SAP FICO Professionals are a key strength for any organization.

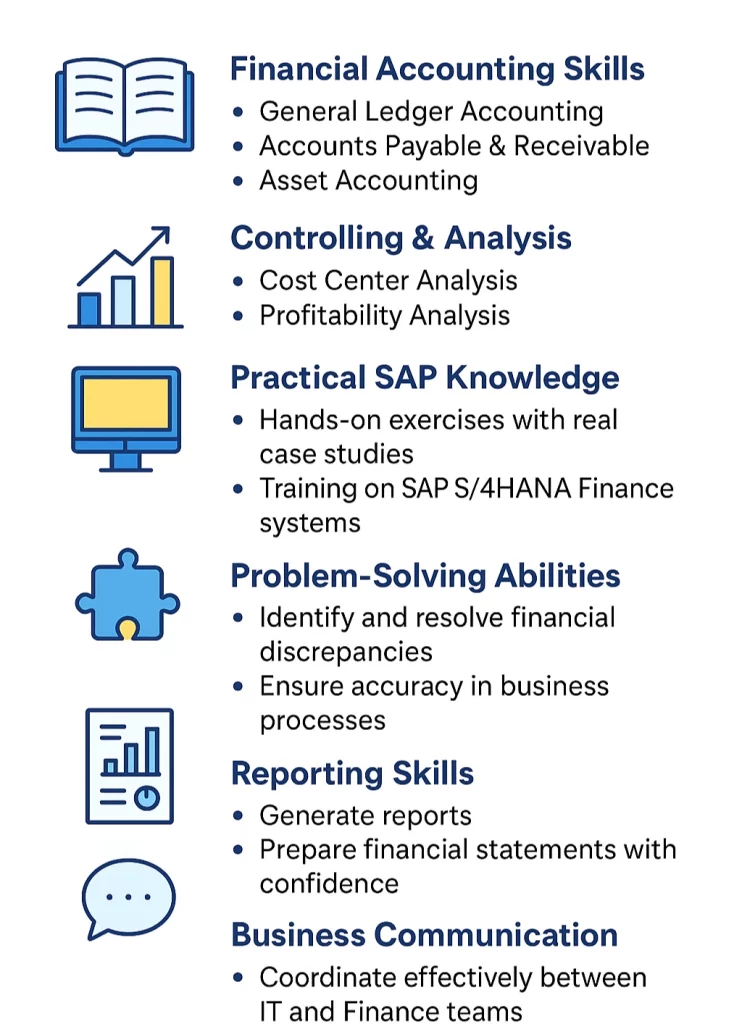

What are the Skills You Gain through the SAP FICO Course?

Through the SAP FICO course, professionals gain both technical and managerial skills.

Qualification Requirements for SAP FICO Course

The SAP FICO course is open to a wide range of learners, from freshers to working professionals wishing to switch their career from the IT field into finance, to understand how it works.

- Graduates: In addition, students with a bachelor’s degree in Accountancy, Business Commerce, Financial Management, Economic Studies, and Corporate Management are completely compatible.

- Post-Graduates: Moreover, Any postgraduate with an MBA or Master’s in commerce (M.com) is a perfect fit for the SAP FICO course.

As a result, professionals willing to upgrade themselves with the SAP FICO course are perfect to accelerate their careers.

SAP FICO Course Syllabus

1. Basics of ERP

- Need and Advantages of ERP,

- Major ERP packages,

- Introduction to SAP and History of SAP, Implementation tools,

- Roles and Responsibilities of a Consultant.

- Types of projects.

2. SAP FI Financial Accounting Basic Settings

- Creation and assignment of the company and the company code.

- Creation of the Business area.

- Defining and assigning the fiscal year variant.

- Defining and assigning the posting period variant.

- Defining open and closing posting periods.

- Defining document type and number ranges.

- Maintenance and assignment of field status variants.

- Defining and assigning a tolerance group of employees

- Taxes on Sales and Purchases( input and output)

- Creation of the Chart of Accounts

- Defining Accounts Groups

- Defining Retained Earnings Account

- Defining Tolerance groups for G/I accounts.

- Real-time issues.

3. SAP FI General Ledger Accounting

- Creation of General Ledger Master

- Display/change/ Block/ unblock of the general ledger

- Master Document Entry

- Posting normal postings with reference

- Display and change documents

- Display of GL balances and Line items

- Parked documents and hold documents

- Creation of the Sample Document and posting

- Defining the recurring entry document and posting

- Configuration of line layouts for the display of GL line items

4. SAP FI Accounts Payable

- Creation of vendor account groups and assignment of number ranges

- Creation of a tolerance group for vendors

- Creation of vendor master (display/change/block/unblock of vendor master)

- How to post vendor transactions, such as payment posting, invoice posting, and credit memo.

- Settings for advance payments to parties (down payment) and clearing of down payment against invoices (special GL transactions)

- Posting of partial payment & residual payment, Creation of payment terms.

- Creation of house banks and account IDs

- Creation of check lots and maintenance of the check register

- Configuration of the automatic payment program

- Payment to vendors through the APP

- Unissued and issued checks, cancellation, and reversal of issued checks

- Defining correspondence & party statement of accounts

- Realtime issues

5. SAP FI Accounts Receivable

- Creation of customer account groups and assignment of number ranges

- Creation of a tolerance group for customers

- Creation of customer master ( display/ change/block/ unblock of vendor master)

- How to post customer transactions, such as sales invoice posting, payment posting, and debit memo. Also learn about settings for advance payment from parties (down payment)

- Configuration of settings for dunning

- Defining correspondence & party statement of accounts

- Real-time issues

6. SAP FI Asset Accounting

- Defining the chart of depreciation

- Defining account determination, screen layout

- Number ranges and asset classes

- Integration with General Ledger & Posting rules

- How to create the asset master and a sub asset master change, such as block/ unblock/display.

- What is the Depreciation key, including base, declining, multilevel, and period control methods? Acquisition or purchase of assets, sale of assets, scrapping of assets, Transfer of assets

- Post capitalization and write up

- Depreciation run line settlement of assets under construction of capital work in progress

- Real-time issues

SAP FI Reports

- Financial Statement version GL reports

- Accounts payable reports

- Accounts receivable reports assets

- Real-time issues

Some More Topics Covered During the SAP FICO Course

| Topics | SubTopics |

| Bank Accounting | 1. Create Bank Key 2. Define House bank 3. Global Settings for Electronic Bank Statement 4. Investment Management |

| SAP CO Controlling Basic Settings for Controlling | 1. Defining Controlling Area 2. Defining Number Ranges for Controlling Area 3. Maintain Planning versions 4. Creation of Primary and Secondary Cost Elements 5. Creation of Cost Element Groups 6. Primary cost element categories and secondary cost element categories 7. Real-time issues |

| SAP CO Cost Center Accounting | 1. Creation of cost centers and cost center groups 2. Planning for a cost center, posting to cost centers 3. Learn how to repost the Costs 4. Create and execute the Distribution cycle, along with the Creation and Execution of Assessment cycles and Cost Center reports 5. Real-time Issues |

| SAP CO Internal Orders | 1. Creation of cost centers and cost center groups Planning for a cost center, posting to cost centers 2. Learn how to repost the Costs 3. Creation and execution of the Distribution cycle, along with the Creation and Execution of Assessment cycles and Cost Center reports 4. Real-time Issues |

| SAP CO Profit Center Accounting | 1. Basic Settings for Profit Center Accounting 2. Standard Hierarchy Creation of Dummy Profit Centers 3. Maintaining versions for profit centers 4. Creation of profit centers and profit center groups 5. Creation of revenue cost elements Automatic Assignment of Revenue elements for profit centers, postings to profit centers, planning, and variance reporting |

| SAP CO COPA Reporting | 1. What is COPA? 2. Maintenance of Characteristics 3. Maintenance of Fields Configuration etc. |

| SAP Integration | Procurement Cycle (P2P) Integration with MMSales Process Integration with SD Integration with asset accounting |

| Complimentary Module: Soft Skills Development | 1. Business Communication 2. Preparation for the Interview 3. Presentation Skills |

| Complimentary Module 2 | Resume Writing |

Length of Course and Fee Structure

The duration of the SAP FICO course and the fee structure depend on each institute and on the course level. Here’s the list.

| Institute/ Course Level | Length of the Course | Fees (approx) |

| Henry Harvin-Power User program | 44 hours | Rupees 26,550 for an Online session |

| For the Beginner level in Henry Harvin ( foundation concepts and practical labs) | 1 and a half months to 2 months | 2200 (AED) |

| SAP FICO Integration in SAP modules and case studies | 3-4 months | 3300 ( AED) |

| Advanced Level- with placement support | 5-6 months | 4500 (AED) |

| Various Pune Institutes | 2-3 months | Rupees 25000-40,000, depending on the level |

Finally, learners can gain in-depth knowledge in the SAP FICO course by completing all the levels and accelerate their career growth. Moreover, through a SAP FICO certification, professionals and freshers are highly sought by employers.

Henry Harvin’s SAP FICO Course

Henry Harvin was started in the year 2013, offering more than 1200+courses through online, offline, and self-paced learning for all courses. Additionally, there are 1840+ professional Instructors training the students across 37+ countries. Henry Harvin UAE is something unique for its placement support, professionally focused syllabus, and finally universally acknowledged credentials, making it a perfect choice for learners.

Moreover, Henry Harvin UAE offers top SAP FICO courses for Finance and ERP professionals. The course has a professionally designed curriculum containing both theory and practical training, giving the learners a complete understanding of the SAP FICO course, including Financial Accounting and Controlling. Henry Harvin UAE offers the SAP FICO course with placement support, guidance for career progression, and a chance to work on real-time projects. Finally, SAP FICO Training is provided for all professionals. Henceforth, learners aiming to upgrade or become a SAP consultant, Henry Harvin becomes a top choice.

Conclusion

Through the SAP FICO course, learners grab more global opportunities than just a learning program. Finally, learners become an expert in ERP systems through combined knowledge in Accounting and Controlling. Whether you are aiming to become a SAP FICO Project Manager, Solution Architect, or SAP FICO Consultant, the SAP FICO course is a perfect choice for career growth.

Recommended Reads

- SAP FICO: Overview and Uses

- SAP Training: Duration, Course Fee, Benefits, and More

- How to Prepare for SAP Certification Exams?

- How To Become a Successful SAP Consultant: Skills and Courses

- What is SAP, and Benefits of SAP Software?

FAQ’s

Ans: Students or learners gain a wide knowledge in Financial Accounting, Cost Center Accounting, Profitability Analysis, Budgeting and Forecasting, Data Management, and Regulatory Compliance.

Ans: SAP FICO Solution Architect earns the highest salary.

Ans: SAP FICO solution Architect earns around 4,20,000 (AED) based on the experience.

Ans: A certified SAP FICO professional works as a SAP FICO consultant, Solution Architect, and Project Manager.

Ans: Beginners earn around ₹6 LPA, while an experienced professional earns around ₹25 Lakh per annum.